allan Government Slashes, Victoria burns

emergency services tax

Until 1 July 2025, every Victorian rate payer paid a Fire Services Property Levy. This was intended to fund your fire service including firefighters’ critical equipment and fire trucks.

Despite this, currently 42% of FRV fire trucks are out of date, dangerous, and should be off the road. By the 2026 State Election, 64% of fire trucks will be out of date, dangerous, and should be off the road. Fire trucks are failing daily. Firefighters’ protective equipment has been compromised. Any of these factors result in firefighters’ lives being put at risk – as well as members of the community and their families.

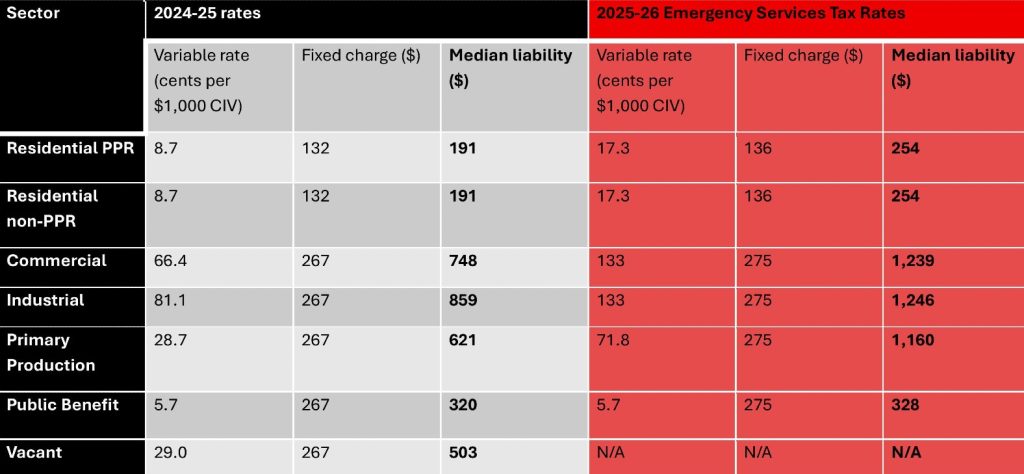

This year, the Allan Government pushed through a new Emergency Services tax on all rate payers – and doubled it. The burden of this significant tax increase will undoubtedly be passed on to renters, small business owners, and farmers. In fact, every member of the Victorian community is affected by this new tax.

All Allan Government Members of Parliament should be held to account over this new Emergency Services tax. Like all Members of Parliament, they depend on the support of their electorates (votes) to remain elected.

We are asking you to make your Member of Parliament accountable for placing you, your family and your property at risk.

Community meetings were hosted by firefighters across Melbourne in April and May 2025. We thank you for your involvement and having your say.

Your voice and your vote matters.

Comparison of 2024-5 FSPL and 2025-6 ESVF variable rates (cents per $1000 capital improvement value)